Paul Blomfield A strong voice for Sheffield Central

Yesterday I was drawn to question the Chancellor in response to his economic statement to the Commons and planned to press him for a fair deal for workers who started new jobs after the cut-off for being furloughed. I would have said:

“The Chancellor will know that workers who started a new job after 28 February were initially failed by the Job Retention Scheme. So they were pleased when he announced a new cut-off date of 19th March – until they read the small print, that employees must have been notified to HMRC through a RTI submission by that date. This is something most employers do at the end of the month, meaning that an estimated 80% of those affected won’t benefit. So will he change that requirement to enable all workers who started their job by the 19 March to be furloughed?”

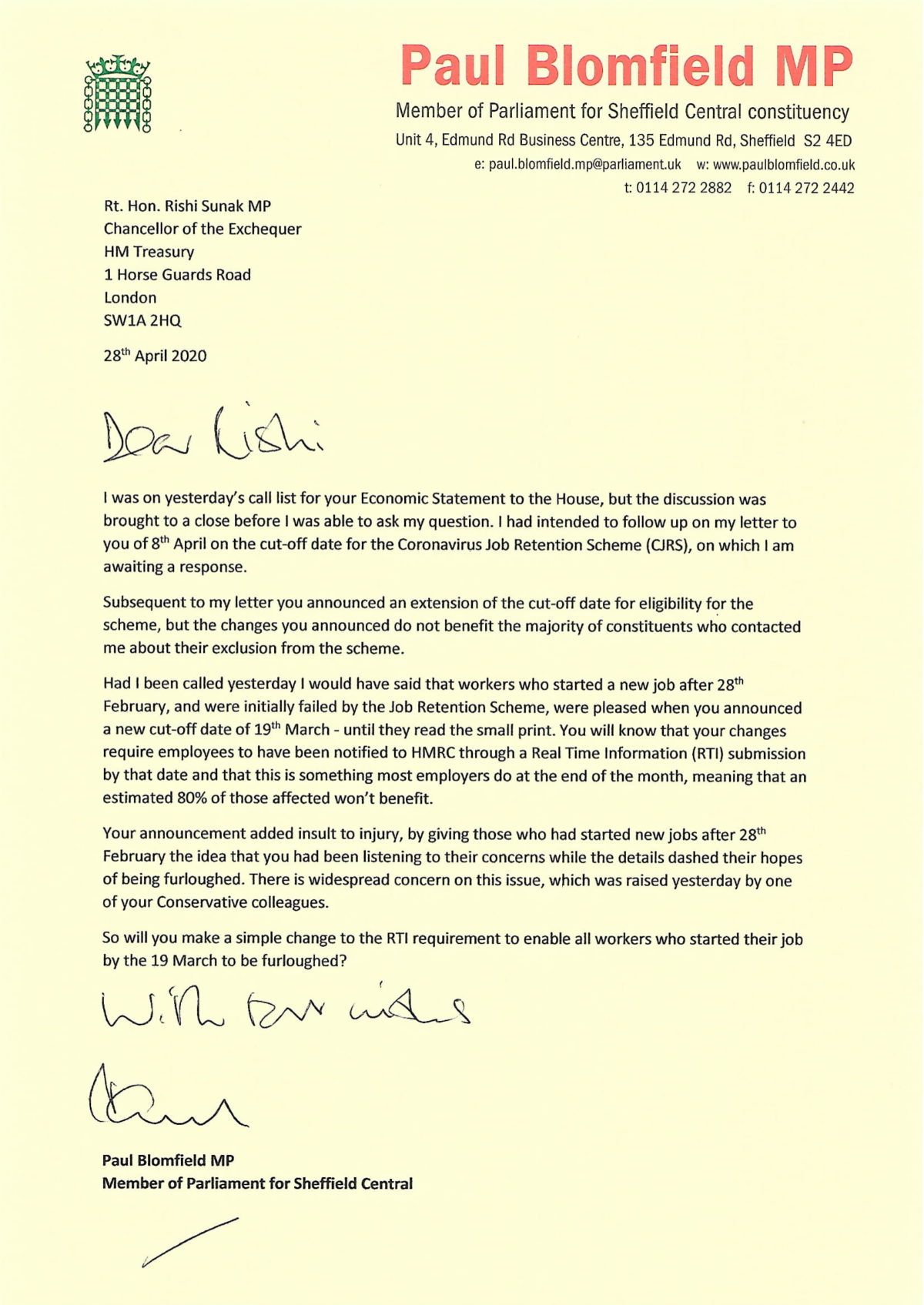

Unfortunately the session came to a close just before I was called, so I’ve written to the Chancellor today (see my letter below) making the same points. The Coronavirus Job Retention Scheme (under which the Government covers 80% of furloughed workers’ wages up to £2,500 a month), was initially only for those on a company’s payroll before 28th February. So I wrote to the Chancellor previously seeking a cut-off date to align with the date that he announced the Scheme.

He then changed the date to 19th March a couple of weeks ago, but only for those whose employer had made a Real Time Information (RTI) submission to HMRC by this date. Initial estimates suggested this requirement would exclude 80% of those who might otherwise have benefitted, and a more recent survey by New Starter Justice suggested that the number could be as high as 95%.

I’ll continue to press for the RTI requirement to be dropped. Read my letter here: